- Fintech firm’s mission is to make hedging FX risks easy and affordable

- Investment values business at €30m as Davy appointed to lead Series A round

- 15 staff recruited in past 12 months with plan to add at least the same again in 2021

- Client base doubles in 2020 as company thrives despite pandemic

Dublin, 08th June, 2021 — Irish foreign exchange technology firm Assure Hedge has closed a €5m funding round to support its plans for rapid expansion. The funds will be used to hire new staff, and to invest in new product development and channels to market.

The fundraising places a €30m valuation on the fintech business whose mission is to transform the way businesses manage their foreign exchange exposure through an easy-to-use online platform.

Despite the pandemic, Assure Hedge has grown rapidly in the past year, adding 15 new staff and doubling its registered client base. The company plans to more than double clients again this year, and add at least another 15 employees.

With over $5 trillion in foreign exchange revenues traded globally each day, Assure Hedge sees a huge untapped opportunity in providing SMEs with the opportunity to manage their currency risk simply and at low cost. Its easy-to-use platform is democratising access to hedging regardless of the size of the sums involved.

Recent research* shows that only 50% of SMEs (defined as companies with turnover of €5 to €20m) hedge their foreign exchange risk, with this dropping to 27% for businesses with turnover under €5m. Amongst the main reasons cited for not hedging risk were complexity, cost, and lack of familiarity.

Assure Hedge’s EZFX Broker product – launched last year – provides FX hedging quotations to SMEs without the need to invest in technology or internal resource for complex treasury management. A new product launch is targeted for July which will enhance accessibility and broaden the range of brokers and financial intermediaries Assure Hedge can work with.

Assure Hedge was launched in 2016 by founder Barry McCarthy, a former financial derivatives trader. It has been funded to date by management and private investors, but has appointed Davy as financial advisor to lead a Series A institutional fund-raising round that will open later this year.

Assure Hedge founder Barry McCarthy said:

“This fund raising will support our continued rapid growth trajectory and provides us flexibility in when and how we engage with institutional investors. Given the response we have had to date we are confident that we are still only scratching the surface of demand from SMEs looking for an easy way to manage foreign exchange exposure. Whether it is coping with the volatility in sterling caused by Brexit, or handling the rollercoaster ride of the dollar through quantitative easing, our mission is to ensure that the ability to hedge foreign exchange risk at low cost is no longer the preserve of big corporates.”

Assure Hedge Chairman Richard Hayes said:

“The management team at Assure Hedge has been hugely impressive in how they have doubled their client base despite the challenges posed by the pandemic last year. Our staff numbers continue to grow rapidly and we are now on the cusp of a new product launch that will expand the channels through which we can access the market, to create a virtuous circle of further growth. I’m optimistic that this is a business set to become another Irish fintech success story by using technology to democratise access to foreign exchange hedging.”

Assure Hedge’s growth has been supported by receiving authorisation to trade in foreign currency options under the EU’s Markets in Financial Instruments Directive (MiFID) in 2019 and the Payment Services Directive (PSD) in 2020. This suite of regulatory approvals from the Financial Conduct Authority in the UK differentiates it from competitors, and gives customers enhanced security and compliance assurance.

Richard Hayes was appointed Chairman of Assure Hedge in 2019, and is a former CEO of IFG Group Plc and Director and seed investor of Cork-based fintech firm Global Shares. Assure Hedge’s non-executive directors include Robert Smith, former CTO of pioneering trading firm GETCO; and Ben Robinson, former CMO of banking software group Temenos.

Assure Hedge is headquartered at Dogpatch Labs in Dublin Docklands and also has offices in London and Portugal.

*East & Partners, March 2021

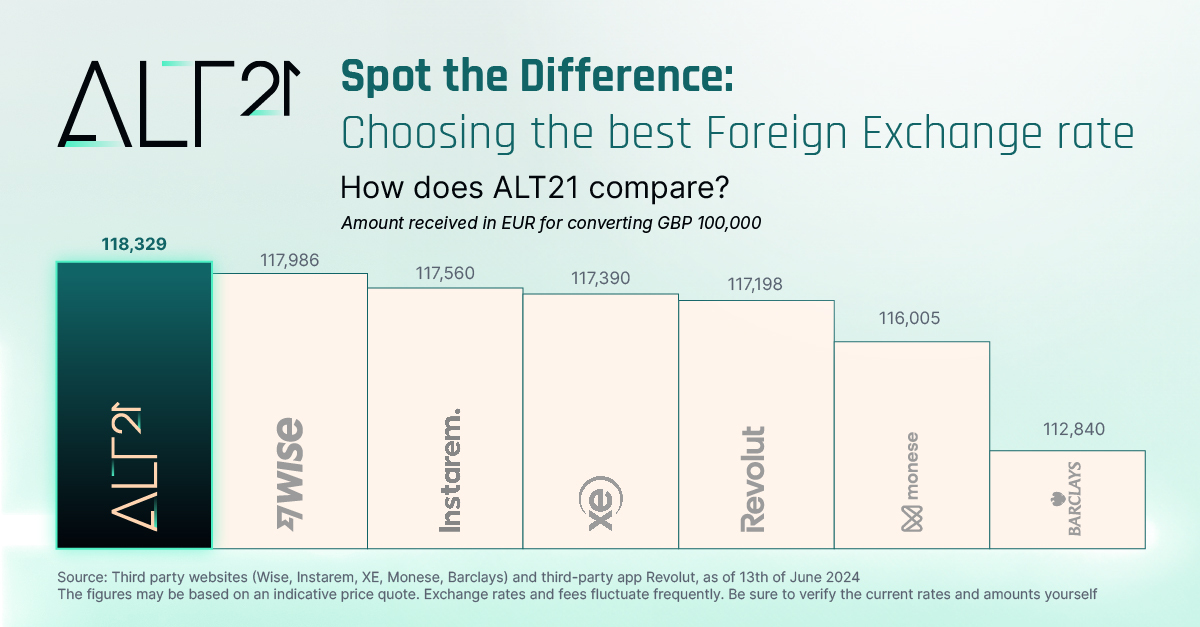

About ALT21

ALT21 is focused on making hedging solutions easy and accessible.

Its end to end platform for FX hedging, offered as a SaaS and managed service, allows financial and non-financial institutions to provide hedging services that are simple to understand, low-cost, and self-service, significantly increasing adoption among SMEs.

ALT 21 Limited, which is authorised and regulated by the Financial Conduct Authority (FRN: 783837) is a company registered in England and Wales (number 10723112). The registered address is 45 Eagle Street, London WC1R 4FS, United Kingdom. The parent company, Assure Hedge Limited, is incorporated in Ireland (No. 578153) with its registered office at 2 Dublin Landings, Dublin DO1 V4A3, Ireland.

Company Timeline

- 2016 Company founded with pre-seed funding from Enterprise Ireland

- 2017 Participation in Financial Conduct Authority (FCA) sandbox process

- 2019 MiFID authorisation approved and Richard Hayes appointed Chairman

- 2020 Offices opened in London and Portugal, £9m margin funding facility arranged with Carrig Glen, and EZFX product launched

- 2021 €5m fund raising completed