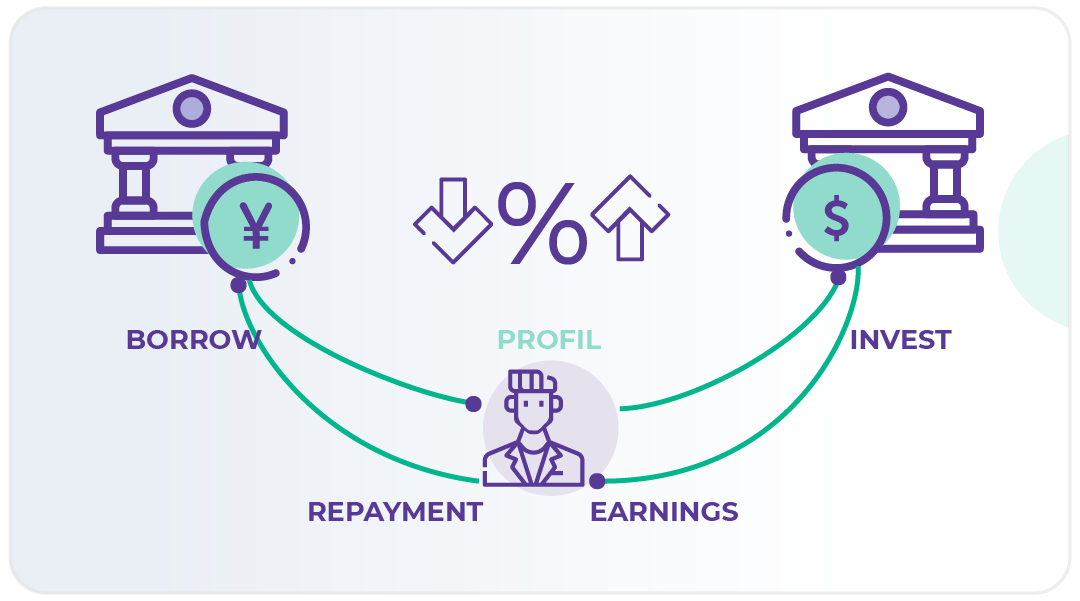

A carry trade is a type of foreign exchange trade in which you borrow money in one currency at low interest and use it to make high-interest investments in another currency. As the name suggests, in a Japanese Yen carry trade, the currency you borrow in is the Yen — Japan’s currency.

Imagine a Japanese bank was offering loans at 1% interest a year.

You borrow ¥6,000,000.

To make the carry trade, you then exchange your ¥6,000,000 for $55,000 which you invest in US bonds that yield 5% a year.

This means you stand to make a profit of 4% a year after settling the debt.

Carry trades have two main benefits.

Firstly, they can generate steady returns.

Secondly, if enough people make the same carry trade, the returns can increase exponentially.

This is due to the laws of supply and demand. The more demand there is for a high-interest investment in a given currency, the more valuable the currency and the investment will become.

Yen carry trades are especially popular because Japan’s interest rates have been extremely low for a long time. This means you can borrow money cheaply and use leverage to maximise your profits.

The flipside is that carry trades can quickly lead to big losses if the currency you borrowed in increases in value or the currency you invested in decreases in value. This is because you’ll earn lower returns and it’ll cost more to exchange money back to the currency you borrowed in to pay off your debt.

Some Facts

- The Bank of Japan has been keeping interest rates low since the mid-1990s in an effort to revive the economy after a stock market crash caused a recession.

- The policy hasn’t helped — commentators have called the period between 1991 and 2021 Japan’s ‘lost decades’. But the Bank of Japan has persisted with its approach. In 2016, it announced negative interest rates. This means Japanese banks now pay interest on the cash they deposit with the Bank of Japan, instead of earning interest on it.

- The most popular carry trade on the forex markets involves exchanging Yen to US Dollars. This is because, where Japan has extremely low interest rates, the US Federal Reserve has kept interest rates relatively high. So, a Yen-US Dollar carry trade has the biggest potential for profit.

- Yen-US Dollar carry trades briefly stopped in 2008 as a result of the global financial crisis. In the aftermath, the US Federal Reserve dramatically lowered interest rates to revive the economy. As a result Japanese Yen carry trades shifted to currencies with higher yields, primarily the Australian Dollar, Brazilian Real, and Turkish Lira.

Want to know more?

- Yen-US Dollar carry trades have been partly blamed for the 2008 financial crisis. This article explains their role, particularly how, once it all went south, the situation escalated due to investors trying to unwind — that is, end — their trades.

- Negative interest rates might seem counter-productive, but there can be sound economic reasons for them. This article explains why a country might consider lowering interest rates below zero and examines the possible implications.

ALT21’s perspective:

“Carry trades — and Yen carry trades in particular — are extremely popular and can be very profitable. But you should approach them carefully. The value of exchange rates is inherently uncertain, so if things start going wrong, you can accumulate losses very quickly.

This is why it’s important to take a long-term view. It’s not just about where interest rates are now, but also the direction in which they’re likely to go. Hedging against exchange rate fluctuations can help you ensure you can limit the damage if things go wrong.”