As the name suggests, a zero-cost hedge is a hedging strategy that doesn’t have upfront costs. The hedge is constructed in such a way that any premium you have to pay to set up the hedge cancels itself out.

To create a zero-cost hedge, you’d typically do the following:

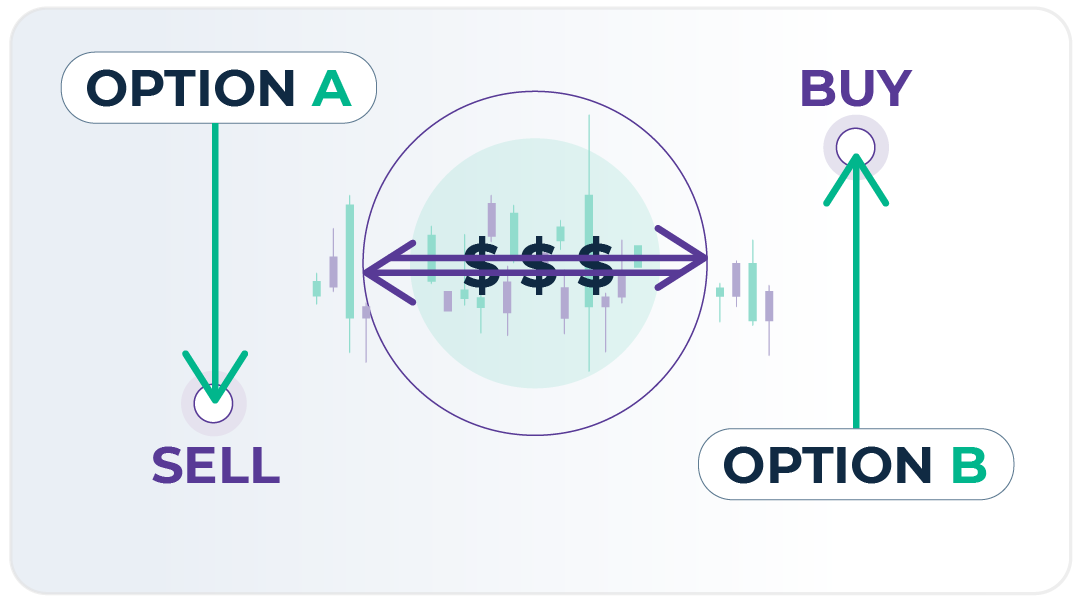

- Buy an option and Sell an option at the same time

The terms of the two options will depend on what you’re hoping to achieve (more on this in a minute). But what’s critical is that both options should have the same premium.

Let’s say you bought an option with an upfront premium of €100.

To create a zero-cost hedge, you’d simultaneously sell an option that has a premium of €100. The €100 from the option you sell compensates for the €100 you have to pay for the other option.

This allows them to fund the purchase with the money they’ve earned from the sale of the other option thus, the net cost of the trade is zero.

How to use a zero-cost hedging strategy

Needless to say, the biggest perceived advantage of a zero-cost hedging strategy is that it has no upfront cost. Whilst allowing you to lock in a range of hedge rates.

Imagine you were hedging your risk on fluctuations in the EUR/USD exchange rate.

You have FX risk to hedge and the exposure is to EUR/USD going up or down. If the Euro depreciates against the US Dollar you would be better off, but if you’re wrong and the US Dollar starts weakening more relative to the Euro, you will lose money.

Let’s say that the exchange rate is currently EUR/USD 1.05.

You could use a zero-cost hedge to protect yourself from the risk of the US Dollar appreciating against the Euro as follows:

- Buy a Call option to exchange your Euro for US Dollar at an exchange rate of EUR/USD 1.10

- Sell a Put option that gives the holder the right to exchange Euro for US Dollar at an exchange rate of EUR/USD 1.03

With a zero-cost hedge in place you will have limited your losses and if the US Dollar appreciates beyond EUR/USD1.10, you can exercise the option.

Of course, the flipside is that your potential upside is also capped.

Some Facts

- It’s important to understand that not all Zero-Cost hedges are easy to understand and there is often enhancements offered by your Bank or Broker and so it’s important to clearly understand the balanced Advantages and Disadvantages on any hedge.

- A zero-cost hedge can be difficult to implement because it’s rare for the cost of the put option to match up perfectly with the price of selling a call option – so hedgers will often employ this strategy after evaluating a range of Zero-Cost strategies to understand the impact of the scenarios on expiry.

Want to know more?

- This video explains zero-cost hedging in detail and shows you a number of scenarios where it can come in useful.

- Because zero-cost hedges involve more than one option, they’re considered an advanced technique. This excerpt from Professor Richard Lehman’s book Options for Volatile Markets: Managing Volatility and Protecting Against Catastrophic Risk, available on ResearchGate discusses a number of other advanced hedging strategies, including put hedge follow-ups and put spreads.

ALT21’s perspective:

‘A zero-cost hedge is a way of protecting yourself from the risk of the market not going your way. But while you don’t have to pay any money upfront, it’s important to understand that there’s still an opportunity cost. You risk forgoing any market gains over the strike price of the option you’ve sold.’