The quarterly roll is a period of heightened market activity that happens every quarter, when forex traders roll their trades.

Rolling is the practice of extending a trade, typically one involving options or futures. Options and futures traded on popular forex exchanges usually have four-month terms, which is why this period of heightened activity happens every quarter.

Unlike traditional stocks, options and futures have expiration dates. This is because of their nature. Options and futures are agreements to buy and sell X amount of a commodity — in forex, this would be a currency pair — at a specified price on a certain date. On that date, the agreement fulfills its purpose and ceases to exist.

As an option or futures contract gets closer to its expiry date, traders have three choices:

Settle

In the case of a futures contract, there’s a legal obligation to buy and sell, so you’ll need to go ahead with the trade.

In the case of an option, you have the right — but not the obligation — to buy or sell. So you can decide not to exercise the option. The price at which you can exercise an option can also be lower than the market price. Here, the option would expire worthless.

Close

To close a trading position, you sell your option or futures contract or open an opposite position. If you have an option to exchange EUR for USD at an exchange rate of 1.20, for example, you could buy another option to exchange USD for EUR at the same exchange rate. The idea is that the two trades will cancel each other out.

Roll

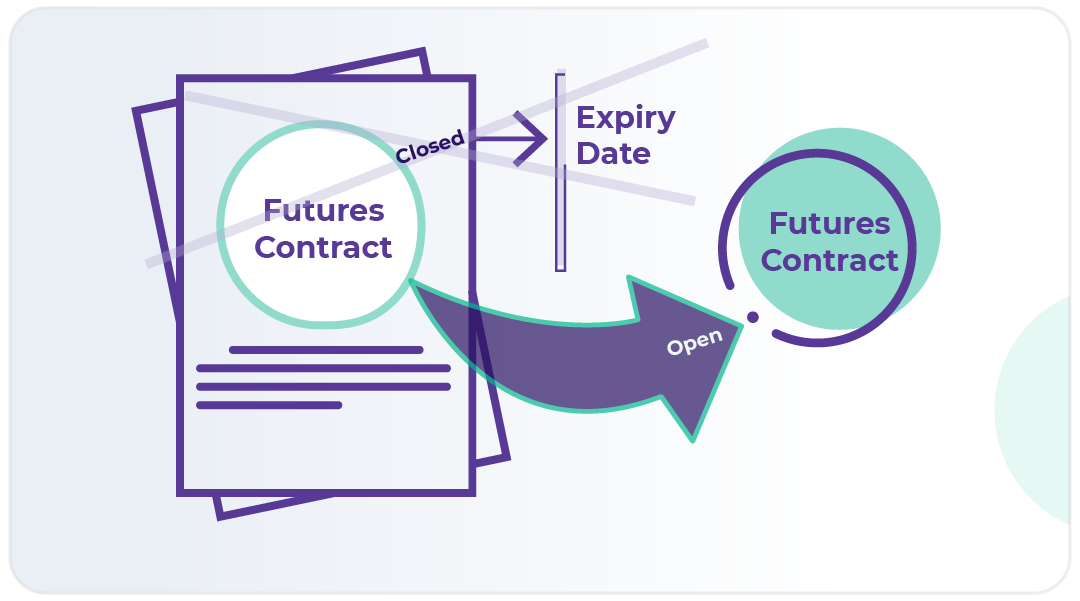

Here, you’d keep your position open by closing the expiring trade and opening a similar one that expires at a later date. So, to roll a futures contract that stipulates you’ll exchange Euro for US Dollars and has an expiry date of 15 September 2021, for instance, you’d do the following:

- Sell the contract

- Alternatively, buy a futures contract that stipulates you’ll exchange US Dollars for Euro and also expires on 15 September 2021

- Buy a futures contract that stipulates you’ll exchange Euro for US Dollars and expires on 15 December 2021

Your trading position will now no longer expire on 15 September. You’ve extended it until 15 December.

Some Facts

- Futures and options traded on the International Monetary Market — the biggest foreign exchange futures and options market in the United States — always expire on the third Wednesday of every March, June, September, and December. These dates are known as the IMM dates.

- The choice of IMM dates is deliberate. Because all the expiry dates are in the middle of the week and the middle of the month, it’s unlikely that, in any given year, more than one of them will fall around a holiday and cause disruption.

- Futures contracts have special codes that make it easy for traders to tell at a glance when they’re due to expire. Each contract has a product code, a month code, and a year code. So, for instance, a mini contract — a contract to exchange 50,000 or 62,500 units of currency — that expires in January 23 would be coded ESF23.

Want to know more?

- Here’s a deep dive into futures contracts codes and naming conventions

- While deciding whether to roll a future is fairly straightforward — typically, you’d roll if you want to keep a trading position open after the original contract expires — deciding whether to roll an option requires more careful thought. This article explains some of the key reasons you’d decide to do it.

ALT21’s perspective:

“Rolling is fairly common in forex trading, but you don’t have to be a speculator to benefit from this technique.

Alongside exchange rate fluctuations, there are also other setbacks that can put your business in difficulty. A contract or shipment could get delayed, for instance. And, in the meantime, the exchange rate could move further against you. Hedging against currency fluctuations — and rolling over those hedges if your circumstances change — helps make sure you stay protected if events you can’t control conspire against you.”